Aloha!

I'm Zasha Smith

From groundwork to generational

wealth, that's been my journey.

I’m a real estate investor and educator born and raised on Maui. I grew up in Section 8 housing with my single mom, who taught me the value of self-reliance, education, and giving back. Her words still drive me today:

"If you want it, go build it. No ones going to hand you a better life - you have to create it."

Before I ever picked up a hammer or raised capital, I spent over a decade as a licensed civil engineer, designing infrastructure for commercial developments across the islands. But after years of creating plans for other people’s projects, I realized it was time to build something of my own.

I started a small, single-family homes, then scaled into multi-family and vacation rentals. What began as a side hustle has grown into a $10 million portfolio of residential and commercial properties in Hawaii and beyond.

In the past three years, I've fixed and flipped 21 properties (with more in the works), raised over $7 million from private investors, and help dozens of local families become first-time homeowners. Many of my rentals are reserved for HUD and Section 8 tenants because housing dignity matters, and I'll never forget where I came from.

My work has also expanded into large-scale investments: I'm partnering in over 500 apartment units across Texas and Florida, a majority owner in an RV park and office complex in Missouri, and now launching a $15 million real estate fund to help both local and out-of-state investors grow wealth through real estate.

Building a future where 1,000 local families can

thrive in Hawaiʻi and not be priced out of it.

Rooted in Every Venture

Along this journey, I’ve also had the privilege of building powerful partnerships rooted in shared values and a mission to uplift our communities.

Co-owner of the

HUI Mastermind

I’m the co-owner of HUI Mastermind, a real estate investing community created to support local families here in Hawaiʻi as they take action, grow confidence, and learn how to invest with purpose.

Fund Officer in

Retoro Capital Investments

I’m the co-owner of HUI Mastermind, a real estate investing community created to support local families here in Hawaiʻi as they take action, grow confidence, and learn how to invest with purpose.

Partner in the

True Wealth Investment Club

I’m the co-owner of HUI Mastermind, a real estate investing community created to support local families here in Hawaiʻi as they take action, grow confidence, and learn how to invest with purpose.

As Featured In

I’m grateful to have shared my story and mission on platforms that amplify real estate, entrepreneurship, and local voices in Hawaiʻi and beyond:

From Civil Engineer to Millionaire Investor

The BiggerPockets Episode That Inspires

“What are you waiting for? You’ve made more on ONE deal than your annual salary.”

This bold challenge from Zasha flips the script on fear and hesitation... she’s not just urging action, she’s lighting a fire under listeners to recognize the massive potential right in front of them. Dive into the episode and get ready to see real estate through a transformative lens.

Empower Your Journey: Zasha on “Keep It Aloha”

Authenticity Meets Ambition in Unforgettable Hawaiʻi Wisdom

“Let the spirit of aloha guide your purpose—and the profits will follow.”

Zasha brings more than real‑estate savvy — she delivers heart and culture. Rooted in aloha, she shows how staying true to your values can drive both personal fulfillment and investing success. Tune in and feel inspired to align your financial goals with genuine purpose.

Zasha on KHON2 News: From Vision to Victory

Discover How Island Values Shape Millionaire Moves

“Investing isn’t just about numbers — it’s about building community and legacy right where you call home.”

Zasha brings a refreshing perspective to real estate, showing how Hawaiian values—ohana, kokua, kuleana—are integral to building lasting success. This isn’t just a financial play; it’s a commitment to uplift your community while growing your wealth.

Wealthy Way by Ryan Pineda Presents

Real Estate Wisdom That Lands Every Time

“Your worst deal isn’t a failure—it’s the tuition you paid to get the next one right.”

Zasha brings no-nonsense clarity to flipping your mindset: every misstep is a lesson, every lost dollar an investment in your future success. She and Ryan dig into how resilience, data, and deliberate action can turn even shaky deals into long-term wins. Perfect for investors ready to school themselves in real-world wealth building.

Real stories. Real strategies. Real estate in Hawai‘i.

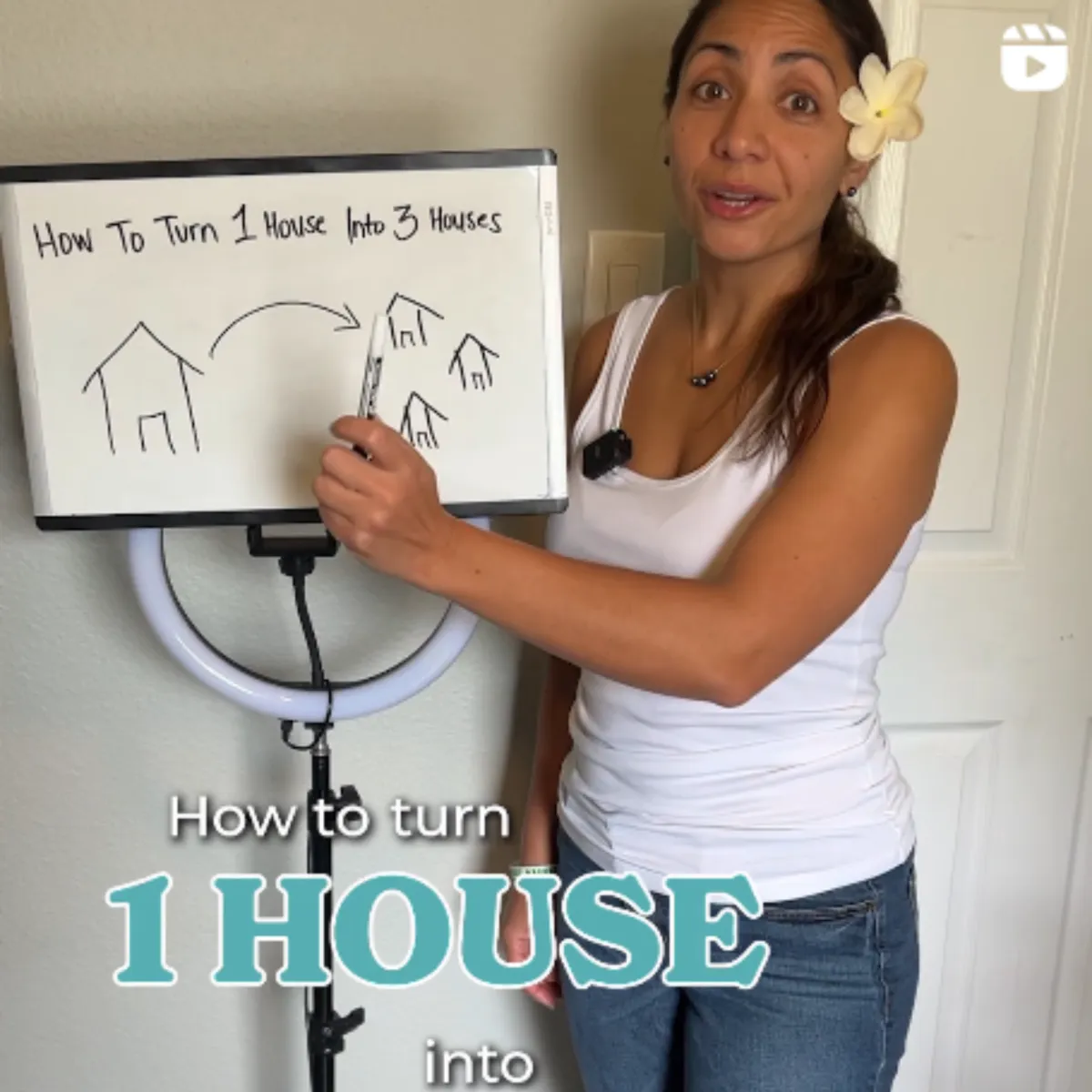

Zasha Smith Channel

Each week, I share how to grow your real estate investing journey in a smart and sustainable way. Whether you're starting your first flip, learning how to raise private capital, or building your team, this channel gives you a clear path forward.

You’ll learn how to stop struggling and start growing with proven systems, strong marketing, and real examples from our local community.

Get Weekly Real Estate Insights from

Zasha and Start Your Wealth Journey

Frequently Asked Questions

If you have more questions, please ask us on our first call!

How much money do I need to invest?

Minimum investments vary depending on the deal, but typically we start at $50k to $100k.

When do I get my money back?

Depending on the deal, it can range from a few months to 5+ years.

What is an accredited investor?

There are 2 tests to determine if you're an accredited investor.

The income test requires that you have an income exceeding $200,000 USD in each of the two most recent years and a reasonable expectation of the same income level in the current year.

For the new worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a new worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities.

What is private lending?

You are the bank. You lend money in exchange for a fixed interest rate.

We handle the hard work and you get "mailbox money" - headache and stress free investing!

What is a syndication?

Real estate syndicators is a way for investors to pool their funds together in order to buy a larger and more stable asset (or assets) than any of them could have on their own.

In exchange for your investment, you get part ownership. The better the property does, the better return you get!

What kind of returns can I expect?

Typical returns range from anywhere from 5-10% annually. If interested in finding out more, fill out the contact form!

Returns vary deal to deal, based on deal performance.

zashasmith.com | All rights reserved. Copyright 2025